Uncovering the Micromobility Opportunity

Summary

Micromobility has a growing presence in cities everywhere, from large urban centres to university campuses. We looked closer into the cities that had kick scooter sharing operations to determine whether there were any similarities to how operators decided which city to launch in. While we did not find strong similarities between cities to draw conclusions, what this research did confirm was that cities and operators need to work closer together to offer new mobility services in a way that truly benefits the people.

With kick scooters appearing in more and more cities, many people are now aware of what this new form of mobility has to offer. The fact that kick scooter sharing has eclipsed over 84 million rides is astounding. While user acceptance appears to be high, we asked ourselves – how well have cities accepted kick scooter sharing?

This is how the Micromobility Readiness Score was created. Looking at all the kick scooter sharing operators in North America, we evaluated cities on factors such as infrastructure, urban density, seasonality, city characteristics, and population. Each city is unique, but we wanted to classify cities with a range of variables that would determine how micromobility is received in a city. These factors were built into the overall score under the larger categories of marketing importance, location potential, ease of operation, and ease of adoption to determine the city’s readiness for micromobility.

General Findings

With launches slowing down, we asked ourselves: are there any patterns to the types of cities that had this micromobility service? Are there any similarities to the cities the second-movers decided to launch in, versus the first-movers?

As we started filling out scores for the 68 cities evaluated, we began to realize there was no discernible pattern between the cities being launched in by operators. The cities that had the greatest number of scooters did not have the highest score, and cities with minimal seasonality did not always welcome kick scooter operations.

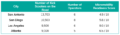

As of June 2019, San Antonio had the greatest number of scooters at 13,700, followed by San Diego with 10,500, Los Angeles with 9,500, then Atlanta with 9,100. Surprisingly, San Antonio only had a score of 4.9 out of 10, whereas Los Angeles ranked the highest with a score of 9.0.

Top 10 cities with the highest Micromobility Readiness Score (from highest to lowest): Los Angeles, CA; San Francisco, CA; New York City, NY; Washington DC, San Jose, CA; Austin, TX; Atlanta, GA; Phoenix, AZ; Boston, MA; Mexico City, Mexico

Bottom 10 cities with the lowest Micromobility Readiness Score (from lowest to highest): Asheville, NC; Fredericksburg, VA; Riviera Maya, Mexico; Tucson, AZ; Peoria, IL; Monterrey, Mexico; Lansing, MI; Little Rock, AR; Queretaro, Mexico

Understanding the Cities

Looking at all the cities that had kick scooter operations, the average Micromobility Readiness Score was 4.4, with the median score being 4.2. One obvious reason for this low score is that American cities are built for automobiles, not for micro forms of transportation. Legislation comes into play as well, as most cities were not equipped to regulate these motorized light electric vehicles.

Less obvious reasons for these lower scores relate to the demand of having a new form of mobility in a city. The calculations accounted for factors such as urban density, congestion, public transportation, and wealth. If a city was lacking a reliable public transportation system, would kick scooters meet people’s mobility needs? In congested cities, do people care enough to help solve the problem of congestion by choosing another way to get around?

Understanding the Operators

The chart below shows the average Micromobility Readiness Scores by operators. Based on where the operator is active, we used those cities’ score to calculate the operators’ Micromobility Readiness Score. In other words, the operators’ score is the aggregate score of the cities they operate in.

Looking at the data this way allowed us to evaluate how operators might decide which city to launch in. We compared this data alongside the launches of kick scooter sharing services. Based on launch dates, we categorized the large operators with more than 3,000 in operation, as the following:

- First movers: Bird, Lime

- Second movers: Spin, Jump, Lyft

- Third movers: Wheels, Razor Share

At first glance, it looks like the first movers, Bird and Lime, focused on getting to as many cities as possible, whereas the second and third movers were more strategic about the location they wanted to operate in. This makes sense because first movers need to gain as much market share as possible, and being backed with venture capital money makes that possible. For the players that followed, they needed to gain market share but also grow it in new cities if possible. Speed was a factor, but marginally less important.

The average score for all the operators is 5.5 out of 10, with the median score being 5.8. This fares higher than the average scores looking at the cities individually. With any new shared mobility service, it is probably too idealistic for operators to only launch in a city with a high readiness for micromobility. However, now that expansion and launches have slowed down, operators need to work closer with cities to build up their ability to cope with new micromobility services. Whether that be building better infrastructure, changing regulations, or educating users, our Micromobility Readiness Score indicates there is room for improvement to make new mobility better adopted in cities.

Preparing for Future Launches

While we were hoping to draw more correlations and concrete conclusions from this round of research, we were intrigued to understand kick scooter sharing from a more data-driven perspective. As previously mentioned, cities and operators need to work in parallel to more effectively bring kick scooter sharing to people. While this process may not be as quick as just entering into a market, operators should appreciate the long term benefit of building strategic partnerships with cities.

Getting into niche markets will be the next opportunity for operators to grow in order to avoid saturating markets that already have a high supply of kick scooters. Operators can take one step back from the mass consumer market and instead focus on growing market share with targeting specific groups of consumers and cities. By building successful partnerships with regulators and having a strong market, operators will be further equipped with the expertise to support their expansion and growth.

If you are interested in starting your own kick scooter sharing service, take these findings into consideration. Once you are ready to turn your business plan into reality, contact us and we can make your new mobility goal possible.