Carsharing: An Industry Overview

Summary

Carsharing keeps growing globally and is playing a critical role in the shared mobility ecosystem. Station-based, free floating, and peer-to-peer services provide different levels of flexibility and pricing for users, depending on their trip needs. New trends are also pushing more multi-modal fleets and new vehicle form factors, making the carsharing space even more dynamic.

Besides bike sharing, carsharing (free floating and station-based) is one of the oldest forms of connected shared mobility, gaining traction since 2010. Since then, we’ve seen more variety of shared vehicles on our streets, ranging from micromobility devices to autonomous shuttles.

The industry is expecting a positive outlook for further development in the near future, partially due to the increase of safe and convenient mobility options in a post-COVID world. The pandemic increased the demand for modes of transport with low infection risk. Shared mobility options rank lower for infection risk than public transit or ride hailing services.

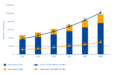

The number of registered users for station-based carsharing services could nearly triple by 2025, from 55 million in 2020 to 147 million in 2025. Based on a report by Berg Insight, the users of free floating carsharing could rise to 43 million by 2025, up from 17 million in 2020. Not only will the number of users grow, but so will the number and size of fleets. All station-based carsharing vehicles could reach a total fleet size of 759,000 in 2025, up from 366,000 in 2020. The forecast for free-floating fleets is for more than 210,000 vehicles by 2025, up from nearly 100,000 vehicles in 2020.

Global growth of carsharing members and fleet

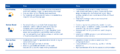

Carsharing business models

We can classify carsharing into free floating, station-based, and peer-to-peer models.

Free floating carsharing

Free floating services let clients pick up and drop off vehicles where they want, in a defined geographical service area. The fleets are larger than in station-based carsharing to ensure a high density of cars and short walking distances for users. Free floating services offer the most flexibility to clients, as one-way trips are possible and the pricing is pay-as-you-use. In addition, clients don’t need to reserve their vehicles; instead they book the fully connected vehicles on-demand via phone apps.

The challenge for operators is balancing supply and demand – they need to offer a density of vehicles that lets users find cars quickly. Free floating pricing is usually offered by the minute (daily rates or hourly packages are also common), while station based and peer-to-peer offerings normally offer multi-hour packages or day rates.

Station-based carsharing

In station-based carsharing, clients need to pick up and drop off the car at the same location. The services use hourly pricing bundles instead of pay-by-minute rates. In some cases, operators also charge a yearly member fee.

Peer-to-peer carsharing

Peer-to-peer carsharing is similar to station-based carsharing. Clients return vehicles to where they started their trips, and rental periods typically need to be several hours minimum. The difference is that the vehicles are either privately-owned and rented out when not in use, or they are owned and managed by so-called micro entrepreneurs. Micro entrepreneurs manage a fleet for several cars and offer them on multiple peer-to-peer carsharing platforms.

Pros and cons of different sharing models

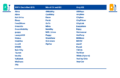

Carsharing around the globe

Share of carsharing vehicles by region in station-based fleets (left) and free floating fleets (right)

Asia-Pacific

As data by Berg Insight show, station-based services dominate the Asia-Pacific region – roughly 99% of shared vehicles are station-based. Asian markets have more regulation, and station-based models align well with local laws, particularly in regard to damage and vandalism control. Only small-scale services in China, Australia, and New Zealand use a free floating setup.

North America

In North America roughly 30% of carsharing vehicles are free floating, the rest is station-based. Several companies tried to scale free floating carsharing, but most reduced or stopped their services. Clients show higher demand for peer-to-peer carsharing in the US. Multiple well-funded startups are building their networks across the country. The setup of peer-to-peer carsharing is more in line with most local mobility patterns and infrastructure.

Europe

Due to the high density of vehicles needed, free floating services tend to focus on larger cities to reach required usage rates of their fleets. In Europe, close to 40% of shared vehicles are in free floating services, with many in tier 1 cities in Spain, Italy and Germany. In addition, around 50 different operators are active in more than 130 cities across the continent. Large, automotive OEM-financed operators like SHARE NOW, Free2Move or Zity still define carsharing in Western Europe. Eastern Europe is seeing an interesting dynamic of more independent and VC-funded players.

Station-based carsharing services are also found in smaller cities and towns, as smaller user bases are enough for smaller fleets concentrated at selected locations. Interestingly, station-based services dominate the UK.

In Germany, there are 14,000+ free floating carsharing vehicles in use by 2.1 million members in 10 to 15 cities. For comparison, station-based services exist in 830 cities and towns, with 12,000 vehicles being used by 724,000 members.

Surprisingly, Russia has become the largest, and one of the fast-growing carsharing markets in the world. Yandex, the “Google of Russia”, entered the free floating carsharing market, creating pressure on other players through low prices and large fleets. The two largest providers combined have more than 37,000 vehicles deployed in Moscow, St. Petersburg, and Sochi.

Carsharing trends

Going multi-modal

Multiple providers are testing or considering multi-modal setups. The first ones were Poppy Mobility and Aimo, who added mopeds and kick scooters in Brussels, Antwerp and Stockholm. GoTo took advantage of increased demand for safe and low infection risk mobility options when they expanded to Spain with a multi-modal fleet launch. At the same time, GO Sharing went from mopeds-only to also include bikes and cars.

Changing pricing structures

Many providers are also trying out new pricing schemes, due to more competition and changing user patterns. The goal is to offer more flexible pricing options linked to client demands. Instead of offering predefined multi-hour packages that put users under pressure to return the car, operators work with so-called cost parachutes to limit the costs per day, week, or even month. Operators are also testing monthly budgets or subscriptions, where users pay a monthly fee to get better per-minute rates and added benefits.

Increasing share of EVs (Electric Vehicles)

More service providers are electrifying their free floating fleets in multiple cities. Almost 40% of the free floating carsharing providers in Europe already use a 100% electric fleet. Operators with hybrid fleets that combine ICE cars with electric ones are adding to the total number of shared EVs. Most carsharing services in dense urban areas in China rely on EVs to comply with strict zero emission rules.

Providers are driving the trend towards shared EVs by their mission to offer emission-free mobility. EVs also help to win the public policy play with cities. Clients demand more emission-free mobility as well.

Multiple auto makers provide EVs for electric carsharing. The Renault Zoe, BMW i3, and Volkswagen e-Golf are present on many platforms. The launch of the Volkswagen ID.3, Peugeot e-208, and Fiat 500e is further adding to the choices in the EV lineup.

Free-floating carsharing split in Europe based on engine type

Increasing share of purpose-built vehicles

In addition to using standard cars for carsharing, operators are trying special purpose vehicles (SPVs). Their focus is either on more durability or a smaller size. Getaround started a service with light EVs for carsharing in Rotterdam, Enuu just launched with small pods in Berlin, and new entrants are preparing to launch in more cities in Europe soon.

Free2Move is the only OEM-funded platform that is already using a SPV for carsharing; the Citroen AMI, used in Europe and North America. Other OEMs like SEAT or Renault have teased small EVs designed for carsharing, but have not declared any plans for next steps. Overall, SPVs could lead to a major cut to vehicle-to-market costs, as well as enhanced user experiences.