Lessons from Discontinued Moped Sharing Operators

Summary

Even though some moped sharing operators have closed down, their experience can teach future operators how to overcome the challenges they faced. This whitepaper dives into how the moped vehicle, technology, and city regulation and infrastructure play a role in determining moped sharing success (or failure).

The focus of research, media and corporate communications often lies on success stories. It lies on growth, expansion and new adventures. All of the mentioned companies in this article have been there, they were successful and then they stopped operations or stopped offering mopeds in their fleet.

The reasons are manifold. In some cases they stopped shortly after launch, sometimes it was a discontinued pilot, other times they shut down or pivoted after years of successful service.

What they all have in common is the expertise in their field. These companies know the hardships of daily operations, the burden of innovating and advocating a new business model in a traditional mobility world. There is no doubt moped sharing today is a success story, as the ever expanding market volume shows (compare Global Scooter Sharing Market Report 2019 or Howe 2020). However, diving into the learnings of discontinued operators can help existing and future operators to continue the legacy of the above-mentioned former operators and help to further transform the mobility system.

For this article we researched public knowledge on the reasons for their business closures and alterations. Additionally, we interviewed selected founders and employees of these early birds in the industry. Let’s open the stage to their individual stories.

Introducing the 19 former moped sharing operators

Who are they?

Almost all companies started as independent startups. Only four had a distinct alternate profile. Notably, the biggest of the analyzed companies, COUP was a Bosch-funded corporate startup. Three other services were initiated by transport/mobility companies: the DB Scooter pilot in Frankfurt (by Deutsche Bahn; Europe’s largest railway company), Enjoy (run by an Eni-backed carsharing company) and Mobility (largest carsharing company of Switzerland). All others’ (15 of the 19 companies), were startups focusing on moped sharing or micromobility in general from their foundation onwards.

Where did they operate?

Most of the operators were located in Europe, three from the USA and one from India. Overall, 11 country markets and 24 cities are represented. This is consistent with the European market domination since the birth of the industry. In 2019, 58 % of deployed mopeds were located in Europe, as well as 82 % of the moped sharing cities.

Looking at the closed companies within Europe, four operators run business in Germany, three each in Austria and Switzerland and two operators each in France, Spain and Poland.

When did they start their service?

The launch date varies strongly in between operators. This needs to be taken into account when it comes to industry maturity. Moped sharing first appeared in 2012. Some of the mentioned companies were launched in the early years of the industry such as Scoot, Jaano, scoo.me, Sco2t, Scootaway or Enjoy. Notably, many of these companies bet on combustion scooters, which is almost unthinkable today in most parts of the world. However, most portrayed operators launched in between 2016 and 2019.

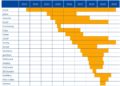

Also the duration of operations varies strongly as depicted in Tab. 2.

Size

Together, these moped sharing operators owned an aggregated fleet size of approx. 9,700 vehicles – a little less than 10 % of the current live global fleet size in mid-2020. The biggest operator by far was German Bosch-funded COUP, which operated primarily in Berlin, Paris and Madrid with a high level of customer acceptance. Further ex large-scale operators include the first moped sharing operator, San Francisco-based Scoot, FaeBikes from India and Scooty from Belgium. All other operators owned less than 250 mopeds at maximum.

The results: What were the obstacles along the way?

We dug into public available statements and analyses on the reasons of operations closure: dozens of newspaper articles, press releases and social media statements.

To start with, there are several categories of obstacles which were identified. Of course, companies might also discontinue due to personal non-market-specific reasons, but these factors are specifically not looked at in detail within this white paper. The interesting takeaways lie in the market-specific factors. Therefore, the following section outlines the most noteworthy reasons of closure/taking the mopeds out of the fleet:

- The moped

- The connectivity & software

- The macro-perspective: Market conditions

- The micro-perspective: City level

- The evolving business opportunity: Pivot

For the deep dive into the discontinuation reasons, first-hand quotes from these operators and more facts and figures, download the full white-paper here.

Download now to read the rest