Multi-Modal Options with Special Purpose Vehicles

Summary

Multi-modal mobility offerings are on the rise. Shared mobility operators either integrate with mobility-as-a-service (MaaS) platforms or start their own activities to become a MaaS provider. In addition, new form factors and special purpose vehicles are becoming more relevant. In this blog piece, industry expert Augustin Friedel takes a closer look at these promising options for shared mobility.

A trend in the shared mobility ecosystem is about offering customers more choice of vehicle types on a single platform. Shared mobility operators either integrate in mobility-as-a-service (MaaS) platforms or start their own activities to become a MaaS platform. Companies across the globe are following different strategies to get to these so-called multi-modal apps.

Partnering to offer multi-modal services

One strategy of single mode operators is setting up partnerships with operators of different mobility offerings and integrating their own and other 3rd party services in a single app. Free Now, the ride-hailing and taxi company, is following this approach in Europe by adding scooters from Voi and Tier Mobility, bikes from Bond, and cars from Miles Mobility and Share Now to their own app. Another example is the rental car company SIXT, which is also partnering with Tier Mobility to offer multiple modes in one app. Prior to the pandemic, SIXT earned EUR 1.7 to 1.8 million revenue per day through the app, which shows the business potential and drives the multi-modal ambition of the originally rental-only company.

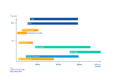

Overview of selected multi-modal platforms (Source: Augustin Friedel)

Building up a multi-modal fleet as an operator

A slower, more capital intensive strategy is for shared mobility operators to create their own multi-modal fleet with different vehicle types. As seen in the table below, companies in different shared mobility verticals are following this approach to expand into new profit pools that could be tapped into with existing and new users. Micromobility companies are climbing the ladder by adding larger vehicles, in addition to e-scooters or bikes. Carsharing companies are going the other way, supplementing their fleet of cars with their own fleet of micromobility devices.

Examples are carsharing companies like Poppy from Belgium or GoTo with multi-modal operations in Spain and Malta. Both operators added e-scooters and e-mopeds to the fleet in multiple markets across Europe. Meanwhile, GO Sharing from the Netherlands is a micromobility operator with plans to add cars and e-bikes to supplement their fleet of e-mopeds. A part of the latest funding round should be used to launch a mixed fleet in multiple markets across Europe.

Lime, a heavily funded micromobility company, explored going multi-modal with cars in Seattle. The project was not as successful as hoped, so it was stopped. However, Lime hasn’t stopped going multi-modal. In fact, the focus is now on a range of shared e-scooters, e-bikes and e-mopeds in Europe and the US. They have also opened up the platform for 3rd party micromobility operators, with Wheels coming onboard as another service provider on the Lime app in selected US cities.

Overview of multi-modal platforms (Source: Augustin Friedel)

An interesting observation could be observed with smaller carsharing providers. CityBee has a strong footprint in the Baltics and wanted to expand into other markets with limited resources. For an expansion to Spain, the carsharing provider decided to start with micromobility devices in Madrid. Poland is another fast growing market for shared mobility, where CityBee wanted to get a foot on the ground and launched with light commercial vehicles. In both Spain and Poland, CityBee wanted to get some traction with reduced investments. With micromobility devices, the total investment needed to build a fleet is significantly lower than in a carsharing fleet. With light commercial vehicles, a smaller and station-based fleet is sufficient to address the existing demand for that vehicle type.

Similarly, Miles Mobility used the same approach with LCVs to stay open in several markets in Germany, when they decided to allocate all passenger vehicles to the top markets based on demand. The fleet of existing passenger cars was allocated to cities like Berlin or Hamburg, where demand and customer base are above other cities. To stay present in other cities like Cologne or Düsseldorf, a fleet of light commercial vehicles was kept in operation. Recently, the approach was used to expand to Bonn and Duisburg.

Addressing diverse mobility needs

Going multi-modal increases the value of the platform for consumers, as they have multiple mobility needs that could be linked to certain vehicle types. For some journeys, a carsharing vehicle might be the best option and for another journey, an e-scooter would be best. Having all on one platform reduces friction and increases comfort for users. Customers have different mobility or transportation needs which should be reflected in the offering. Depending on the situation, users select the mode of transportation based on costs, distance to be traveled, availability or purpose of a trip.

As seen in the illustration below, it could make sense for carsharing providers to offer micromobility options on their own platform. Majority of the trips are below the car range by distance, so there is a huge demand. Diversifying the offering on their own platform would generate more interactions and revenue, as the users would book more often.

Trip distribution by distance (Source: Barclays)

For ride hailing and taxi platforms, the narrative of going multi-modal is driven by costs. In the schematic visualization below, it’s obvious that the price per km for taxi and ride hailing is at the top of the range. Diversifying the services on the app by adding shared micromobility or cars would create more options for price sensitive customers. And again, a car is not always the preferred mode for short trips, especially if we think about dense urban areas.

From an operator’s perspective, offering multiple modes on a single platform increases the number of interactions on the platform, attracting more customers and enabling cross-mode bookings. It’s important to balance out possible substitution effects so that the overall net revenue for the platform goes up.

Cost per mile and preferred modes by traveled distance (Source: Augustin Friedel)

Technological challenges of going multi-modal

If an operator opts to build its own multi-modal fleet, decisions regarding vehicles, software, and operations need to be planned carefully. The core of every multi-modal fleet needs to have a reliable tech stack that handles the specifics of different vehicle types and models properly to meet the expectations of both operators and users. The fleet owner relies on comprehensive data points for each vehicle in order to manage the fleet efficiently. It’s also critical that the technological solution in place is providing a seamless user experience across the different vehicle types on the multi-modal platform.

In the end, it all comes down to the reliability and flexibility of a multi-modal fleet’s IoT and how it connects vehicles with the operator’s backend software and booking app. Working with multiple form factors and different vehicle makes or models could become complex, so it’s recommended to select a technology provider that is able to manage these complexities. A vehicle agnostic IoT solution would increase the bargaining power of the platform during vehicle sourcing processes. Moreover, the operator does not have to fear any lock-in effects with the first selected vehicle brand or model and has flexibility in scaling and differentiating with other models in the future. A powerful IoT solution also provides benefits for optimizing the maintenance and service events for each vehicle. In addition, the collected data could be used to enhance the re-marketing value.

Besides software and IoT, vehicle selection is the most critical make-or-break decision. The overall goal is to reach a low total cost of ownership level for maximum profitability. The total cost of ownership level is defined by multiple factors like vehicle purchase price, maintenance costs, vehicle loss rate, software integration costs, durability, and others. A calculation model with all the factors could be set up prior to the vehicle decision to get full transparency on the real total cost of ownership.

Special Purpose Vehicles (SPVs) for Sharing

To optimize the value to customers while reducing the total cost of ownership, shared mobility operators and automotive groups are thinking about special purpose vehicles. Special purpose vehicles (SPV) are designed from the ground up to meet the expectations and requirements of customers and users. Experts predict that the total cost of ownership is lower compared to the vehicles that are used today. Lower complexity and limited variations could speed up the development and production cycles.

This approach of SPVs is promising but also linked to certain challenges. So far, SPVs have been more common in ride hailing and sharing services. MOIA launched the ride sharing service in Hamburg and Hannover with a unique electric van, designed for privacy and comfort. In China, the leading mobility platform DiDi is partnering with the car manufacturer BYD and others to increase the share of SPVs on the platform. The fleet of SPVs on the DiDi platform is growing rapidly, around 400 cars are produced per day.

In carsharing services, the Stellantis mobility brand Free2Move is using small electric car sharing vehicles in Paris, Madrid, and soon Washington DC. The Citroen AMI is a full electric and slow speed vehicle that is classified as a quadricycle. In France, these quadricycles could be also driven by people 14 years or older, which could potentially broaden the pool of users for Free2Move in Paris.

As a next step, more SPVs should be tested in new pay per use mobility offerings in the US. Mobilize, the new mobility brand by Renault, is working on multiple SPVs for sharing and transportation. All devices are electric and optimized for expectations and requirements of the different use cases.

However, getting SPVs to work for carsharing is challenging. The former Autolib’ carsharing service in Paris was created based on the SPVs developed and produced by Bolloré Group. The service was stopped basically overnight due to high operating costs, low vehicle performance and suboptimal quality of the service. The vehicle was called Bluecar and it was also used for sharing services in Los Angeles and Singapore, but both projects also failed.

Even in more recent projects, SPVs have been a challenge to operate. Getaround, a leading peer-2-peer carsharing platform, launched a pilot project in Rotterdam to explore the space of small electric vehicles for sharing in dense urban areas. The demand for the Biro vehicles was good but the pandemic stopped the project. This year, a startup called Enuu started in Berlin with a fleet of small electric vehicles that were imported from China. The service had to hit the pause button a few months in, as riders didn’t stick to the parking rules. The small EVs were parked on sidewalks often, creating a hazard for pedestrians.

Besides the challenges around operations, regulations, and user behavior, the typical small fleet sizes per carsharing operator could be a roadblock for wider adoption of SPVs in carsharing. Let’s take Share Now as an example: with a fleet of 11,000 vehicles across 16 cities in Europe, the carsharing operator is one of the largest players on the market. The fleet of 11,000 vehicles put Share Now on a top spot among the largest car sharing networks but this fleet size is still too small to justify the development and production of a SPV. It would be impossible to reach necessary production costs for SPVs to gain a benefit on total costs of ownership.

To reach levels of scale, multiple car sharing providers would need to cooperate or the demand for car sharing services would need to increase dramatically. McKinsey has estimated that only 0.3% of all shared mobility trips are carsharing, more than 98% are ride hailing and even micromobility is more popular than carsharing with close to 1% of shared rides.

Both multi-modal approaches and the deployment of special purpose vehicles for shared mobility are in early stages. The forecasted business potential is triggering increased activities by automotive OEMs, existing mobility platforms, and investors. The coming 18 to 24 months will generate more signals and proof points if users accept and use multi-modal offerings and if SPVs are an option to optimize the cost base of a fleet used for shared mobility.