Four Cities Paving the Way for E-Bike Sharing

Summary

Electric bikes have risen in popularity over the past few years, and can be found in many bike sharing services. Major cities like Paris, New York, Berlin, and London are leading the way when it comes to shared electric bike adoption.

Bike sharing is as established as it gets in shared mobility. It has been around for a long time with growing and proven success. Today, more than 10 million shared bikes are rolling across many regions around the world. To get an overview, check out the Meddin Bike-sharing World Map. From initial pilots with small fleets of shared bikes, to digitization advances in the 1990s and 2000s, to the introduction of dockless bike sharing in the 2010s, bike sharing has a long history and is here to stay. At the same time, business models are constantly diversifying to address different use case needs. In fact, over the past few years, we’ve witnessed the growing success of a new form factor – the shared electric bike.

The e-bike boom – owned and shared

Even before the pandemic, e-bikes had left the niche market and became more mainstream. However, the pandemic accelerated the growth of electric bikes across the globe. European countries, who had already seen remarkable growth over the past few years, recently saw annual growth rates between 30% and 40%, while the United States saw a 145% increase in sales. Most of the bikes sold came from the B2C market, or in other words, personally-owned bikes. With the boom of personally-owned e-bikes, the shared e-bike market is also growing and becoming less of a niche offering.

An unwritten law of today’s mobility landscape is that major cities need to have a well-functioning bike sharing scheme. For many years, the success of station-based (docked), hybrid, and free-floating (dockless) systems proved the viability of bike sharing. For a couple of years now, cities have been experimenting with e-bike sharing pilots, with great success. Utilization rates, willingness to pay, and satisfaction rates were high. The ease of use is pushing new user groups to become shared mobility adopters and speeding up the diffusion of shared mobility overall.

One of the first success stories in e-bike sharing usage was the former operator Jump, before it got acquired by Uber, then by Lime. The initial success of Jump and other shared e-bikes set an example for many operators. Today, more and more shared micromobility operators are planning to deploy e-bikes.

Alexander Gmelin, CPO at INVERS, believes that “the pandemic may have accelerated the worldwide adoption of e-bikes and micromobility in general, but this e-bike trend, together with mopeds and kick scooters, will continue to play an integral role in the electrification of mobility in our cities for years to come. Micromobility solutions tick all the boxes when it comes to today’s urban mobility needs, and fill in the first and last mile gap that has long existed.”

When asked about e-bikes specifically, Alex sees them as “a safe and sustainable mobility option; easy-to-use and accessible for a wider range of demographics; and can get you farther faster without getting stuck in traffic or on hilly terrain. That’s why we see huge success and growth potential for new customers who are looking to start an e-bike sharing service and for established customers who are looking to expand their shared mobility services to include multi-modal micromobility options such as e-bikes.”

E-bike sharing around the world

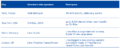

To showcase the ongoing success and depth of innovation, we looked at four global metropolises and their current fleet of shared e-bikes: Paris, New York, Berlin, and London. We chose them because of their success with large scale, human-powered bike sharing services (without electric engines). We found that e-bike demand is growing in these cities, and fleets are growing with e-bikes and becoming valuable additions to bike sharing services.

Paris

Paris is well known for its massive Vélib’ system (known as Vélib’ Métropol since 2018). It launched in 2007 and is one of the longest-serving bike sharing systems globally. Since 2018, Vélib’ has offered electric bikes as part of their service offering, and the total fleet size is getting close to 20,000. With an increasing number of electric bikes, Paris is one of the global leaders in e-bike sharing. Their mix of shared bikes are also easy to find and distinguish from one another: blue bikes are electric and green bikes are mechanical/human-powered.

According to the Vélib’ website:

“Moving around is made much easier thanks to a fleet of bicycles which is 30% electric: Vélib’ users see their journeys shortened and defy the city’s hills to climb them with ease. With a range of 50km and a top speed of 25km/hour, the electric Vélib’ bicycles represent a genuine alternative to the use of private cars that pollute the atmosphere.”

The service is constantly evolving to meet consumer demands. Delivery services have been heavily using the electric bikes and 27% of all users are subscribed to the V-MAX annual subscription model, enabling them to ride an electric bike for free for the first 30 minutes.

New York

New York is the city of Citi Bike. Citi Bike is one of the largest bike sharing services globally, offering 21,500 bikes at over 1,400 stations. Citi Bike also has 4,500 shared e-bikes in their fleet. Most notably, Citi Bike has exclusive rights to operate bike sharing within NYC boundaries.

Recently, JOCO launched a new electric bike sharing service in New York, deploying “hundreds of e-bikes … at 30 privately-owned locations in Manhattan” and aims to have 800 bikes by fall 2021. Their stations are located on private property to get around Citi Bike’s exclusivity rights, and JOCO has argued that this makes them independent from Department of Transportation authorization.

Berlin

Berlin has recently become a bike sharing haven over the past few years. Currently, the biggest fleets are supplied by city-subsidized Nextbike (tender winner), Call-a-bike (Deutsche Bahn-run, former official city bike sharing), Lime, and Donkey Republic.

These operators have been experimenting with electric bikes for quite some time now. Currently, Lime has the largest electric bike sharing fleet. After acquiring Jump, they deployed part of the fleet in Berlin. Cargo bikes can also be electric – the local bike sharing service, fLotte, offers more than 160 cargo bikes for free, with around 10 of them being e-bikes from different manufacturers (ie: Bakfiets, Babboe, and Douze). Another recent e-bike pilot, Wheels, also entered the Berlin market, but was active only for a short time.

London

London has experienced quite the number of electric bike sharing services as well. The biggest bike sharing operator in town is Santander Cycles with 10,000+ bikes. Though the bikes remain non-electric for now, several other operators are electrifying the bike sharing landscape in London. Specifically, Lime, Freebike and HumanForest are driving this trend. Lime reintroduced the former Jump bikes after a short break in 2020, Freebike offers free rides for specific user groups (mainly selected local council, hospital, and trust employees), and HumanForest started their pilot in 2020 and is planning a full launch this year.

Tab. 1.: Selected e-bike sharing operators in Paris, New York, Berlin and London as of May 2021

In a nutshell, electric bikes – both personally-owned and shared – are booming. Cities around the world are increasingly attracting e-bike sharing operators. We’ve highlighted examples from Paris, New York, Berlin, and London that are providing a growing number of shared e-bikes. Without a doubt, e-bike sharing is a stable and well-received form of shared mobility, and is ultimately here to stay.