Global Moped Sharing Market Report – Launch Event Recap

Summary

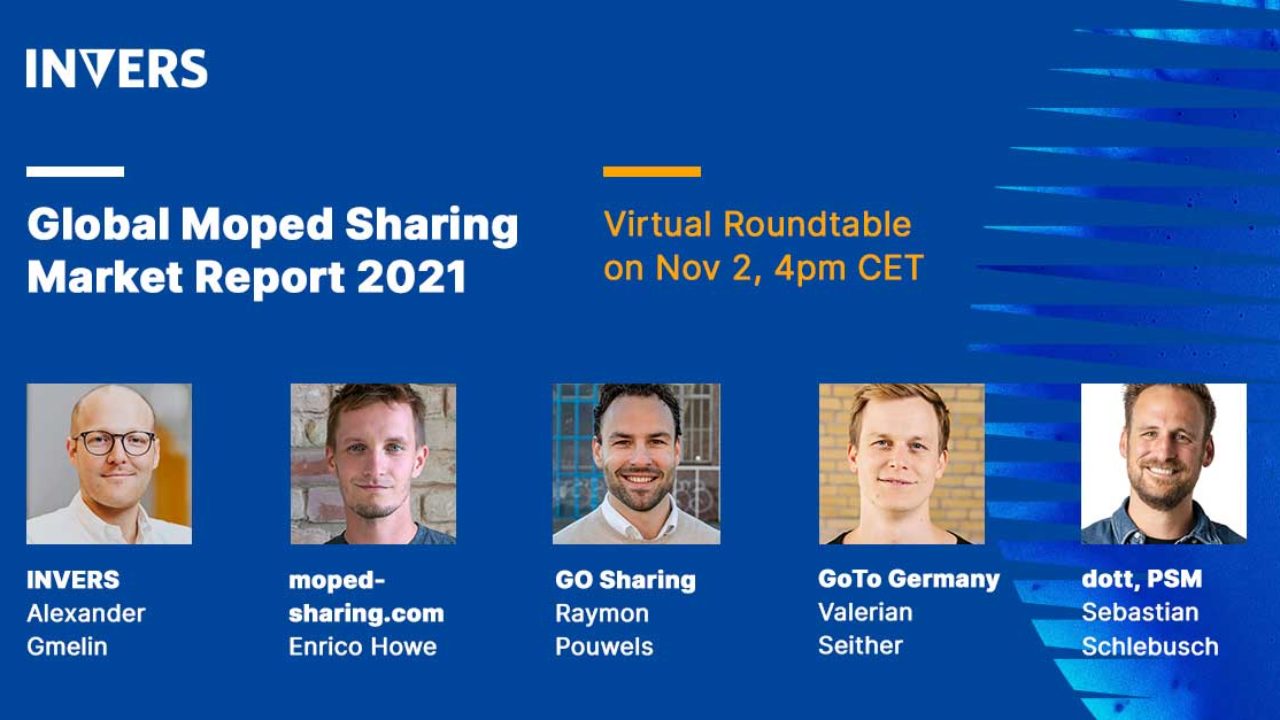

On November 2nd, INVERS and mopedsharing.com launched the Global Moped Sharing Market Report 2021 during a digital round-table panel event. Report co-authors Enrico Howe from mopedsharing.com and INVERS CPO Alexander Gmelin discussed the results and implications of their study with industry experts Raymon Pouwels, Co-Founder and CEO at GO Sharing; Valerian Seither, Co-Founder of emmy and currently Managing Director at GoTo Germany; and Sebastian Schlebusch, Head of Market Development at Dott and speaker for micromobility at Plattform Shared Mobility. The panel agreed that density of available vehicles is key to success, that multi-modality is the way of the future, and that customer retention is increasingly important in an industry where competition is getting fierce. Read on for their thoughts on those topics and others in the following panel recap.

Following a brief overview of the top areas of growth and most apparent moped sharing trends outlined in the report, moderator Enrico Howe from mopedsharing.com engaged the panelists in a discussion on topics as diverse as the impact of the pandemic on the industry, different pricing models, the likelihood of market consolidation, and the current and future possibilities for using data collected by shared vehicles.

The entire presentation is worth watching to see the panel’s opinions and answers to questions from Enrico and the audience; here we will highlight the four trends that came up most often:

Customers are already multi-modal

One of the lessons that Valerian Seither learned from his successes in moped sharing is that while operators are beginning to embrace multi-modality by offering more than one type of vehicle for sharing, customers are already multi-modal and may be “sick of using different apps” for each different type of vehicle that they want to use. GoTo Germany will likely be adding cars and e-bikes to their platform in Q2 2022 to respond to those various needs, while some progressive cities are already offering multi-modal tenders for shared vehicle operations.

To be able to meet their customers’ and their cities’ needs for multi-modality, operators will need to weigh the pros and cons of adding variety to their fleets by building it themselves or by choosing a partner that complements what they have. The estimated payoff, according to Valerian Seither, may be a four or five-fold increase in revenue per customer.

Cooperation with cities is increasingly important

The initial “free for all” open market approach to shared mobility in cities has often been problematic, and we’re starting to see more regulation. Not all of the new regulation has been well designed; Sebastian Schlebusch quoted the first-come-first-served approach from Rotterdam that shuts out new entrants as well as the lowest-price approach by Zaragoza that “created a price war and not necessarily quality service” as examples of regulation that could have been designed better. He also emphasizes that it’s the industry’s responsibility to create the understanding that good regulation “creates a competitive environment but also creates reliability and investment stability.” The industry is currently very interested in the upcoming tender for Paris, which has the biggest moped-sharing market in Europe and whose tender may become a model for future European moped sharing.

Cooperation with cities will also be crucial when it comes to increasing the density of available shared vehicles. “Density is key” for customers according to Raymon Pouwels, and getting infrastructure in place is the key to more density according to Sebastian Schlebusch. Research shows that customers’ willingness to walk to the nearest vehicle drops significantly as distance increases; 100-150m should be the maximum distance to the nearest micromobility vehicle, which translates to 30-40 locations per square kilometer. To achieve this type of density, operators will need more access to public space, which is scarce and is fiercely protected by city officials. Organizations like Plattform Shared Mobility are working with governments at municipal as well as national levels to make sure the industry’s voice is heard when it comes to the vision and plans for public mobility.

Competition is fierce

The high level of competition in the market is making customer retention more important than ever. GoTo Germany is taking a community-based and emotional approach to their messaging and business so that their customers “open their app first” according to Valerian Seither. Operator multi-modality will likely strengthen customer retention, as customers prefer to have options or simply “may not want to get on a scooter in the rain.”

Intense competition will also likely lead to more market consolidation; we’re likely to see more mergers and acquisitions like GoTo Global’s recent acquisition of emmy – now called GoTo Germany. The panel didn’t give an exact guess as to when we will see more consolidation, but it was agreed that it’s definitely coming.

Finally, increased competition combined with the previously mentioned trend towards multi-modality may result in more pricing options for customers as operators look for differentiators. Subscription pricing may become more prevalent if single operators offer all the different types of vehicles that a customer may want to use.

In the end, the panel agreed that the biggest competitor remains the privately-owned vehicle. New entrants of other shared vehicles like cargo bikes and e-bikes into local markets may actually be helpful according to Valerian and Raymon, as they will help shift the culture away from private vehicle ownership and use and encourage people to use multi-modal shared vehicles instead.

Technology is driving changes at an impressive pace

Last year’s report indicated that 77% of the world moped sharing fleet is electrified; by the end of October 2021 that number was 97%, with the last major combustion-engine market (India) starting to also show clear signs of electrification. Alex Gmelin pointed out that while most operators are using their own staff to swap out the batteries in their electric scooters, the industry is noticing the success of sharing operators in Taiwan who created the infrastructure for users to swap the batteries themselves. Taiwanese moped sharing users have done 200,000,000 battery swaps themselves, and it should be expected that operators everywhere else will also want to implement similar systems and technologies to reap the associated cost savings.

New data and new insights from existing data is another area where the industry is likely to see technology-driven change soon. Alex predicts continuing insights from operational data such as fuel/battery levels, tilt angle to find fallen mopeds, and the status of helmets. He also expects operators to take actions and make adjustments based on user data such as the presence of passengers on shared mopeds (which can be determined by the status of the second helmet) or using driving analysis features and data to identify dangerous or irresponsible drivers. Finally, he’s fascinated by the potential of noise sensors, air quality sensors, or temperature sensors mounted on mopeds; this kind of “value added data” could be very useful to cities where the mopeds are operating.

Download the report for context, then watch the entire presentation for the panel’s complete opinions on the topics above as well as their thoughts on better connections between public transit and mobility-as-a-service (MaaS), the impact of integrating with Google maps, and how the industry was and continues to be affected by the pandemic.